Best Car Loan Interest Rates & Eligibility in the UAE for Expatriates (2025/2026)

If you are an expat living in the UAE, personal mobility is essential for everyday life. To serve that need, getting a car is a must, but it is not just about finding the right one. If you plan to finance the car, it is crucial to know how banks price their loans and what you actually qualify for.

KEY TAKEAWAYS

Why do expats prefer to take out car loans to purchase in the UAE?

Expats prefer to take out car loans in the UAE to preserve cash liquidity and to build a credit history that will facilitate future financing.What are the top banks in the UAE that finance car loans to expats?

Emirates NBD, FAB, ADCB, RAKBANK, and Dubai Islamic Bank.Walking into a car showroom without knowing the real details is not the smartest way to shop for a car. Not being fully aware of the key aspects could land you in a costly mistake. We try to tell you everything you need to know about car loans and interest rates in the Emirates.

The Key Difference: Flat vs. Reducing Interest Rates Explained

Flat Rate: Generally, the bank charges interest on your original loan amount for the entire tenure. If you take AED 100,000 at 3% flat for 5 years, then you pay 3% on that full AED 100,000 every single year, even when in reality you are paying down the principal every month.

Reducing Balance Rate: Here the interest is calculated only on the outstanding balance. You get a benefit as your principal shrinks; with each payment, so does your interest. This amount is the real cost.

The math: A 2.5% flat rate equals around a 4.7% to 5.0% reducing rate. A 3.5% flat rate? That's closer to a 6.5% to 7.0% reduction.

Banks in the UAE typically advertise rates in the range of:

- New cars: 2.5% to 4.5% flat (roughly 4.7% to 8.5%)

- Used cars: 3.0% to 5.0% flat (roughly 5.6% to 9.5%)

Islamic banks refer to profit rates instead of interest, but the calculations yield the same results. Emirates Islamic, for instance, shows 2.65% flat for expats, which translates to 5.01% reduction.

It is sensible to look for reduced rates that work for you.

Minimum Monthly Salary (subject to profile)

|

Bank |

Minimum Monthly Salary (Expats) |

Interest Rate Range (Reducing) |

Key Feature |

|

Emirates NBD |

AED 7,000 |

4.10% - 7.50% |

Green auto loans for EVs |

|

First Abu Dhabi Bank (FAB) |

AED 7,000 |

4.10% - 6.51% |

Salary transfer may be waived for select profiles or listed employers |

|

Abu Dhabi Commercial Bank (ADCB) |

AED 5,000 |

3.79% - 7.00% |

Flexible for 2+ years UAE residents |

|

Dubai Islamic Bank (DIB) |

AED 3,000 - 5,000 |

4.72% - 6.50% |

Islamic finance, low entry barrier |

|

Abu Dhabi Islamic Bank (ADIB) |

AED 5,000 |

5.00% - 6.80% |

Salary transfer may be waived for select profiles or listed employers |

|

Emirates Islamic |

AED 5,000 |

5.01% - 6.50% |

Islamic finance options |

|

Commercial Bank International (CBI) |

AED 5,000 |

4.50% - 7.00% |

No mandatory salary transfer |

|

Bank of Baroda |

AED 4,000 |

5.50% - 8.00% |

Caters to South Asian expats |

Disclaimer: Rates, eligibility and salary requirements vary based on employer category, credit score, tenure and salary transfer arrangements. Final offers are subject to bank approval.

The reality: Most banks advertise AED 5,000 as the minimum, but the sweet spot of AED 7,000 to AED 8,000 makes a huge difference.

Government employees and those working for approved companies may get better deals, with 0.5% and 0.75% lower rates.

Used Car Finance

Among the New vs Used cars, the used car financing makes things a little harder for the borrower.

Age Limits: Most UAE banks won't finance a car that's more than 7 to 8 years old.

Example: You plan to buy a 5-year-old car with a 5-year loan. By the end of the tenure, the car will become 10 years old. Most banks will reject this equation, and the preferred maximum combined age is typically 8 to 10 years.

But if you're buying through Al Tayer Motors, Premier Motors, or Abu Dhabi Motors, FAB, and some other banks extend the limit to 10 years at maturity with proper Selling or Transferring Cars in the UAE.

Down Payment Requirements:

- New cars: 20% minimum (Central Bank regulation)

- Used cars: 30% minimum (70% LTV ratio)

Loan Tenure:

- New cars: Up to 60 months (5 years)

- Used cars: 36 to 48 months, depending on age

Shorter tenures mean higher monthly payments but significantly less interest paid overall.

Expatriates Need The Following

Personal papers: A passport with residence visa, Emirates ID and A UAE driving licence

Income Proof: Salary certificate and bank statement.

Vehicle Documents:

- A quotation from the dealer

- Valuation certificate

- An insurance quote

Check out the necessary details at the Latest Tips to Renew Your Car Insurance Online in UAE regarding Insurance renewal.

Additional Requirements for Expats:

- Some banks ask for a home address in your home country

- Reference from a UAE resident

- Employment contract or job offer letter

New expats with less than 6 months in the UAE have to face tougher verification

Credit Score Matters

Getting a car loan depends on your creditworthiness and bank access through Al Etihad Credit Bureau.

Monthly EMI: An Affordability Check

Use a Car Loan Calculator: Most UAE banks offer online calculators.

Zigwheels also has a dedicated EMI calculator that allows quick check on various cost scenarios instantly.

For example:

- Car price AED 80,000

- Down payment AED 16,000 (20%)

- Loan AED 64,000

- Interest rate: 5% reducing (roughly 2.6% flat)

- Tenure: 48 months

Your EMI: nearly 1,475 every month

Total interest paid: Nearly AED 6,800

What should you do?

It's always better to do some rough estimates before you plan to visit the dealership. Use an EMI calculator to figure out your comfortable monthly payment. Then work backwards to determine your realistic car budget.

Conclusion

Over the years, with growing demand and a rapidly evolving automotive market in the UAE, the car loan market has evolved and become highly competitive. This is a works out in favour of the borrower, as you have multiple options to choose from. A smart approach would be exploring the options, at least three banks minimum. And, as competition always does, there are chances to negotiate to get a better deal, especially if you have a good credit score or salary transfer.

Keep in mind, don’t consider the lower monthly payment to be the best deal. It may look great as a smaller monthly outlay, but you end up paying a lot into the future, over the course of the loan duration.

So, basically, check your eligibility, run the numbers, and then make your move. That's how you buy a car the smart way in the UAE.

Also, check out our Corporate Car Buying Guide in the UAE - New Fleet Benefits for Businesses.

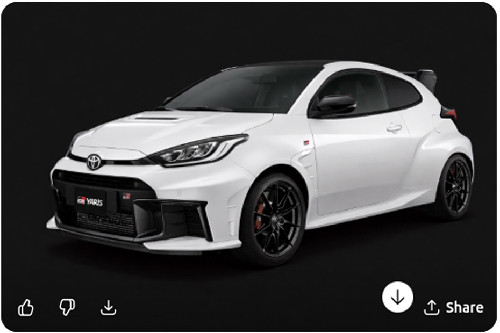

Toyota Car Models

Automotive News and Reviews

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Car

- Latest

- Upcoming

- Popular